01

Social security policies

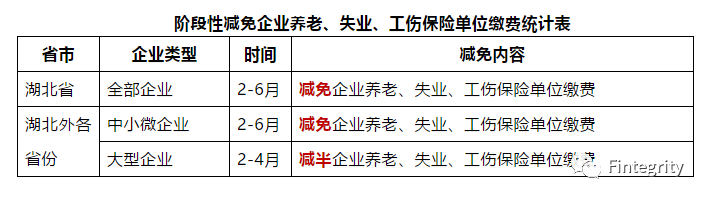

1. phased relief enterprise social insurance premiums, provident fund can be held over! From February to June, the national (except Hubei province) small, medium and micro enterprises can be exempted from pension, unemployment, industrial injury insurance unit payment; From February to April, large enterprises across the country (except hubei province) can halve the collection of pension, unemployment and work-related injury insurance unit contributions; Hubei province from February to June can all kinds of ginseng protects an enterprise to avoid to collect endowment, unemployed, inductrial injury insurance unit pay cost.

Before the end of June, the enterprise can apply for deferred payment of housing provident fund, during this period due to the impact of the epidemic on the staff can not be normal repayment of provident fund loans, do not make overdue processing.

2.February has paid social security insurance enterprises will be refunded by the provisions!

At present, tax authorities are responsible for collecting social insurance premiums and medical insurance fees for enterprises in 18 provinces and three cities that are listed separately in the state plan.

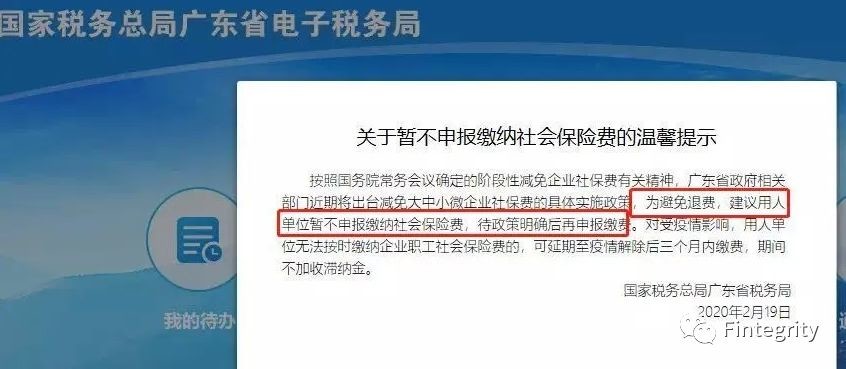

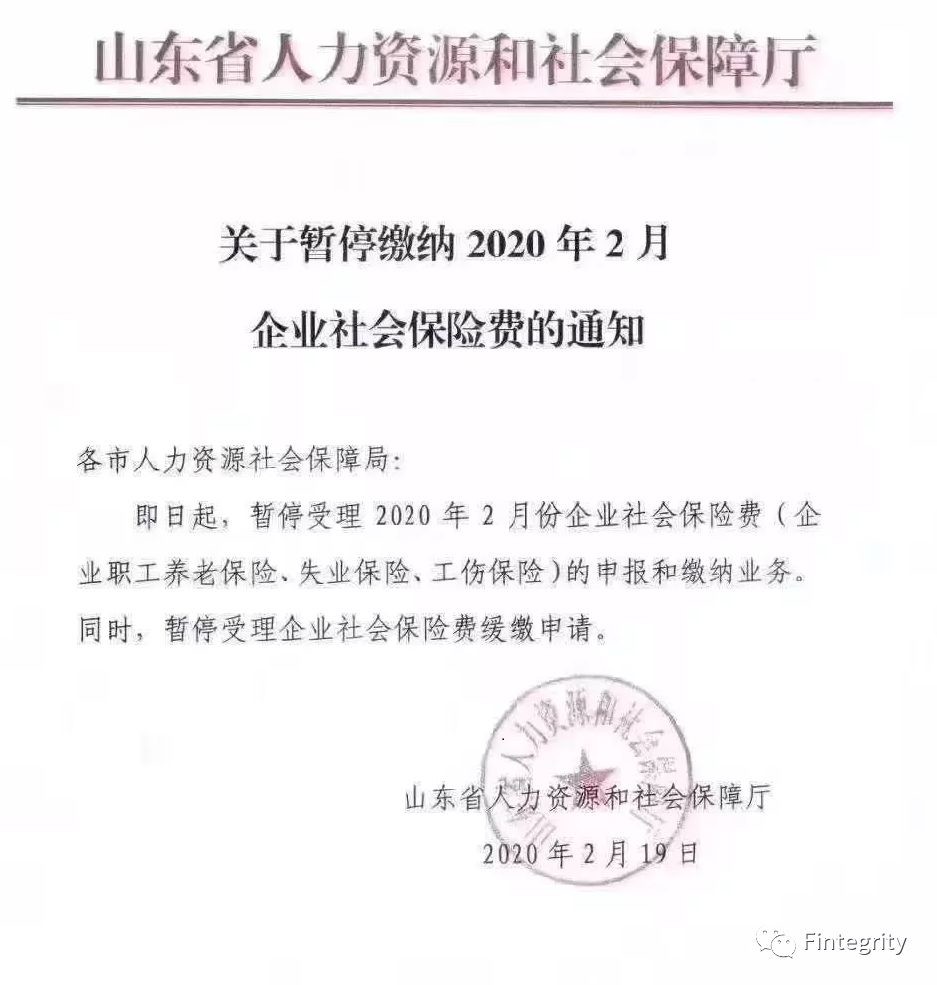

The deputy director of the state administration of taxation said at a recent press conference on the state council's joint prevention and control mechanism that some enterprises that paid social security premiums and medical insurance fees in February will be refunded in accordance with regulations to ease their business difficulties. This is undoubtedly a good news for the enterprise! I hope more smes can survive! Can the social security premium paid be refunded? What about the ones that haven't been handed in yet? Before the country made clear is to temporarily exempt part of the enterprise 5 months social insurance premiums, hubei region is all enterprises! Actually after social security New Deal sends out, countrywide each district is in implement! Shandong and Guangdong, for example, have issued notices suggesting that social security payments for February be suspended.

02

How to surrender?

How can I refund the social security premium paid in February? Documents related to social security refund issued by Beijing municipal human resources and social security bureau.Key points:

1.participating units that have withheld the social insurance premiums for the month of January 2020 May apply for refund of the fees due to their actual needs. Apply for the ginseng that returns a fee to protect a unit, its social insurance premium of February will no longer continue to deduct automatically. In afore-mentioned ginseng protects an unit, had dealt with emeritus, transfer to continue, dead clear wait for the personnel that involves account clear kind of business, such personnel social insurance premium of January does not deal with refund, the social insurance premium of other personnel returns a fee to be able to deal with normally.

Feburary 17 solstice 21 applies for the ginseng that returns a fee to protect an unit, the social insurance premium of January that has withheld capture will be returned before feburary end protects an unit bank account. 22 solstice 29 applications for refund of the cost of the participating insurance units, the January social insurance premiums have been withheld will be returned to the bank account of the participating units in March.

2. Participating units that have already withheld social insurance premiums for the month of January 2020 May also choose not to refund the fees and apply for social insurance premiums for the month of February only.

3. For those participating units that have already withheld social insurance premiums for the month of January 2020, if they fail to apply for the extension of payment to the end of march in accordance with the above requirements, the social insurance premiums for the month of February will continue to be automatically withheld in accordance with the original process.

4. Those participating units that fail to withhold social insurance premiums in January 2020 do not need to submit an application, and the collection period of social insurance premiums in January and February will be automatically extended to the end of march.

03

A few big mistake

Meanwhile, as a small and medium-sized enterprise, Fintegrity also reminds us to pay attention to the following misunderstandings:

Erroneous zone 1: This is exempt from three risks in social security, is the unit to assume part and individual to assume part to be exempted from?

Correction: This periodic reduce enterprise endowment, unemployed, inductrial injury insurance unit pay cost, must notice, unit pay cost is to point to unit pay cost part, do not contain worker individual pay cost part.

Erroneous zone 2: Is it right from February to June to all enterprises can be exempted from three fees in the part of the unit cost?

Correction: This phased reduction of enterprise pension, unemployment and work-related injury insurance unit contributions, all provinces except hubei, from February to June can be exempted from the above three fees for small, medium and micro enterprises, from February to April can be halved for large enterprises; Hubei province from February to June to all kinds of insurance enterprises can be exempted.

Erroneous zone 3: She works in the office institution, this social security relief preferential policy they can also enjoy?

Correction: Since government agencies and public institutions are not involved in business problems and are less affected by the epidemic, they are not included in the exemption policy.

Erroneous zone 4: This social security executes derate, be to the enterprise with difficulty of a few capital affected by epidemic disease cannot apply for to defer social security to pay?

Correction: Affected by the epidemic, enterprises with serious difficulties in production and operation can apply for the suspension of payment. The period of the suspension is not more than 6 months in principle.

Erroneous zone 5: This time social security 3 fees implement derate, is the division of medium small micro enterprise and large enterprise differentiate according to the caliber of tax bureau?

Correction: The classification of enterprise types is based on the statistical data of the statistical department. In accordance with the relevant provisions of the ministry of industry and information technology, the bureau of statistics, the national development and reform commission and the ministry of finance (miit joint enterprise [2011] no. 300), all provinces shall determine the objects of exemption and exemption for enterprises in light of their own conditions, and strengthen information sharing among departments, so as not to increase the burden of enterprise affairs.