In the last article, we talked about expense reimbursement and highlighted several types of invoices that should be rejected.

This week, Fintegrity is going to share some tips on expense claims.

We know that in the daily expense reimbursement work, an expense report may need to be revised several times, the financial department said not according to the tax law, financial standards reimbursement, invoices, taxes, tax risks... All have accountant bear, reimbursement colleague thinks the finance is not enough reasonable, work is inflexible... Such arguments are likely to happen every day.

SO ~ This time we will mainly talk about how to standardize the reimbursement of expenses.

Four tips

1:Fill in the expense report must be standardized

(1) the lowercase amount and the symbol of RMB shall not have Spaces, and shall not be written together. Wrong writing: ¥100;

(2) the amount in words without part number with zero or completion;

(3) the reimbursement form shall not be altered. If there is any mistake, it shall be filled in again.

(4) the amount shall be filled in according to the standard, and there shall be no writing errors, especially the capitalized amount;

(5) the lowercase amount shall be consistent with the uppercase amount;

(6) the items should be completed. The reimbursement department, reimbursement time, reimbursement items and the number of attached sheets should be completed.

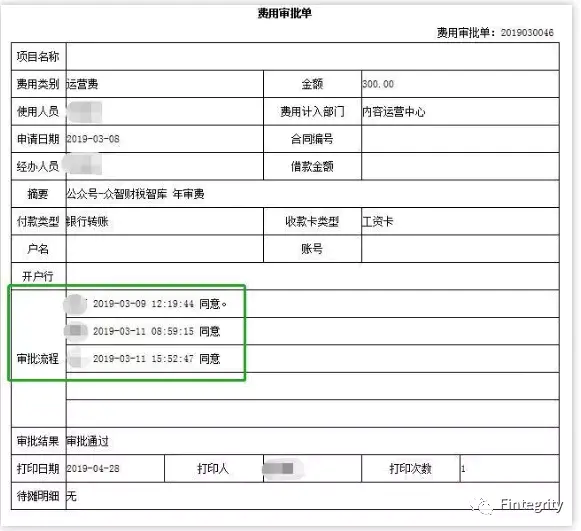

2: the signature of the responsible person on the expense report must be complete

Requirements: the reimbursement form or the expense reimbursement form must be signed by the person in charge of reimbursement, the person in charge of finance and the person in charge of the department.

I remember that there was a period of time before, the expense reimbursement process of huawei was very popular in the circle and passed on as a good story.

In the process of reimbursement approval, huawei has established an expense reimbursement integrity file for each employee, and each employee has an integrity score. This score determines the probability that personal expense claims will be audited.

The initial score of the employee is 80, B, etc. After each reimbursement of a sum of expenses, if there is no error, you can add 1 point, the maximum accumulation to 120 points.

Integrity score for 80-90 points, internal audit spot check proportion is 20%;More than 90 points, spot check proportion is 10%; Above 100 points, spot check proportion is 5%;

The score is below 80 points and all expense reimbursement needs to be checked.

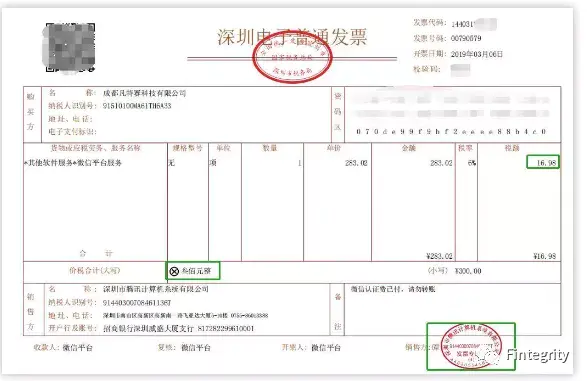

3: reimbursement voucher must be complete

(1) the invoice should be stamped with the seller's invoice special seal, and the name of the seller is the same, otherwise not reimbursable;

(2) the seller's financial seal is required to be stamped on the receipt, without which reimbursement shall not be allowed;

4: Note paste to specification

From now on, the invoices for these 8 expenses cannot be reimbursed:

1. Received a taxi invoice with the supervision seal of the old invoice.

2. Received a VAT invoice, only the name of the buyer, no taxpayer identification number.

3. Received an ordinary VAT invoice in roll form. Product name: office supplies, no specific details!

4. Received an ordinary VAT invoice. Product name: office supplies, there is a list, but the list is not printed out from the billing system, but the seller made a copy with A4 paper!

5. Received an expense report for the training meeting. There is a training meeting list, but the list is not printed out from the hotel system, and the meeting organizer made a copy on A4 paper.

6. When going to the supermarket for shopping, the actual purchase contents of the invoice are moon cakes, fruits, etc., but when going to the service center for invoicing, the invoice contents will be issued as office supplies, etc. (invoice for change of commodity name)

7. Purchase from party a and accept party b to issue invoices through party a's introduction or approval of party a's arrangement. (third party invoice is accepted)

8. No shopping, directly false invoice. (completely overinvoicing)

Situation 1: to issue invoices for others and for oneself that are inconsistent with the actual business situation

For example:Sold 3 apples, the invoice is 2 apples, this is false; Sell the apple 5 yuan a jin, the invoice is 7 yuan a jin, this is false; Things sold to a, but the invoice issued to b, this is false; A sells things to b, but the invoice is written by c to b, which is false and so on. Namely: the seller on the invoice, the buyer, the name of the commodity, quantity, unit price, amount must be consistent with the actual business, there is a difference, that is false.

Situation 2: ask others to issue invoices inconsistent with the actual business situation For example, in order to evade tax, company A's legal representative asks company B, whose friend is the legal representative, to issue an invoice for company A without actual transaction. Here, company A and company B both belong to the behavior of over-invoicing.

Situation 3: introduce others to issue invoices inconsistent with the actual business situation There are two situations again inside this, one is professional, namely the way that makes money with this, act as "broker" in the role between billing party and receiving party, earn intermediary poundage, this kind belongs to know law to break the law; The other kind is the enterprise that happens to know to have redundant bill and the enterprise that lacks bill, in order to help the idea of friend favour becomes introduction person, this kind of behavior mostly belongs to ignorant law result. But whether or not you know the law, whether or not you charge a referral fee, once this kind of behavior occurs, you must accept the legal sanction is the same.

Two reminders for accounting invoice :

1: By April 1, the focus will be on monitoring taxpayers who wrongly invoice in advance at the new tax rates of 13% and 9%. The new tax rate will come into effect from April 1, so don't choose the new tax rate in advance.

2: After April 1, the focus will be on monitoring the situation of enterprises wrongly invoicing with the old tax rate.