Important reminder!!

Annual report of 2019 is in progress

Don't keep up with the annual report!

In order to avoid the detour of each boss in the annual report filling process

Fintegrity lists five common mistakes in the annual report!

Remind the accounting friends who have not yet declared to avoid pitfalls,

At the same time, it also gives the declared friends a direction of self-examination and correction.

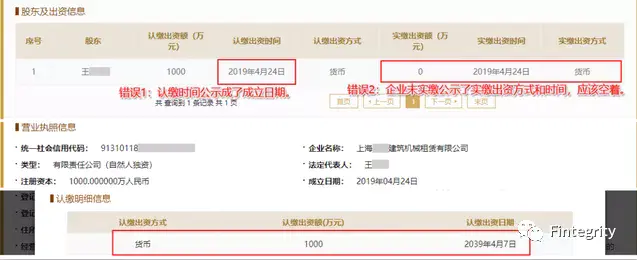

Part 1 the difference between paid in and subscribed in is not clear

Mistake 1: the subscription time has been publicized as the establishment date

Analysis: the annual report declaration personnel do not understand the subscription time and fill in according to the establishment date.

Correct operation: the subscribed capital contribution information shall be filled in accordance with the articles of association.

Mistake 2: the enterprise has not paid in, and publicized the way and time of paid in capital contribution

Analysis: according to the information filled in the figure, the enterprise did not make the paid in capital contribution, but the filling personnel filled in the time of subscribed capital contribution.

Correct operation: the amount and time of the paid in capital shall be filled in according to the bank receipt or capital verification report. If the paid in capital repeatedly, the paid in amount shall be the total amount of the paid in capital repeatedly, and the paid in capital shall be the time of the last payment.

Mistake 3: take the paid in capital as the subscribed capital

Analysis: according to other information in the annual report, the subscribed capital contribution of the company is 4 million and 3 million respectively, and the actual capital contribution is 100000 and 280000. No distinction is made when filling in the shareholder and capital contribution information.

Correct operation: the subscribed capital contribution shall be filled in according to the amount and time specified in the articles of association, and the actual capital contribution shall be filled in according to the bank receipt or capital verification report, and the two shall not be confused!

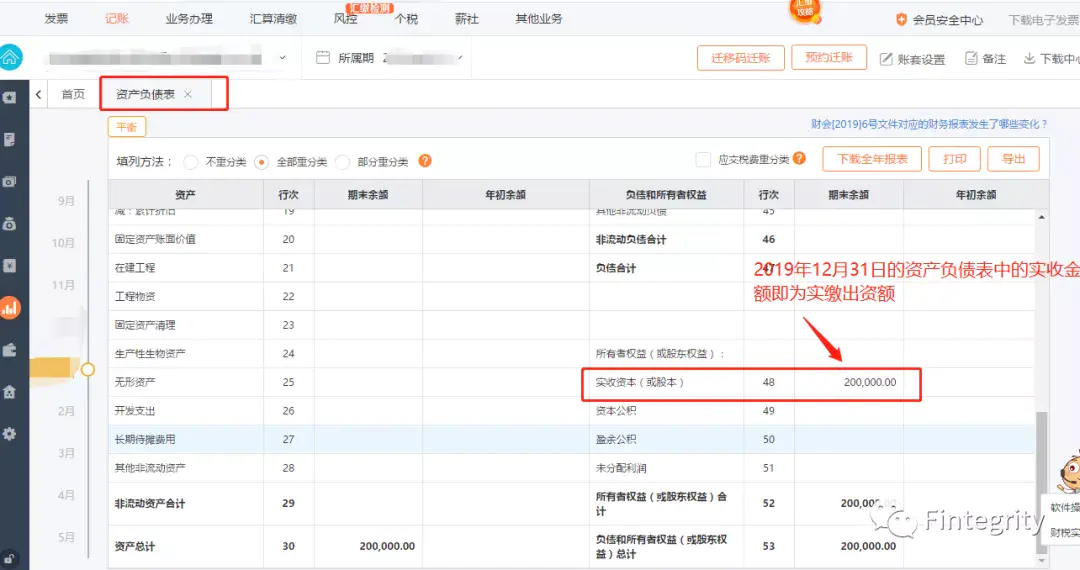

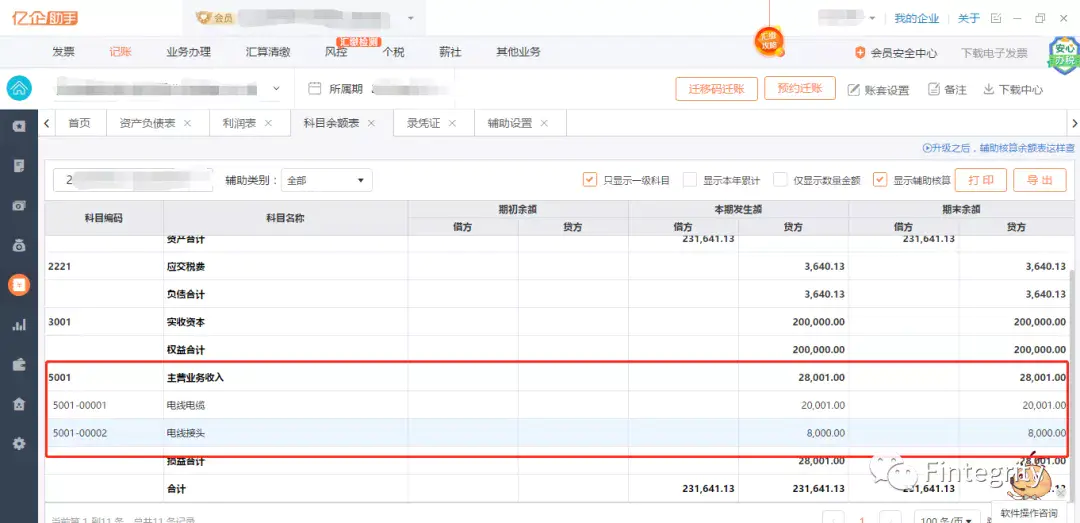

Warm tip: the paid in capital contribution can also be filled in by checking the balance sheet of paid in capital (capital stock) at the end of December 2019, as shown below!

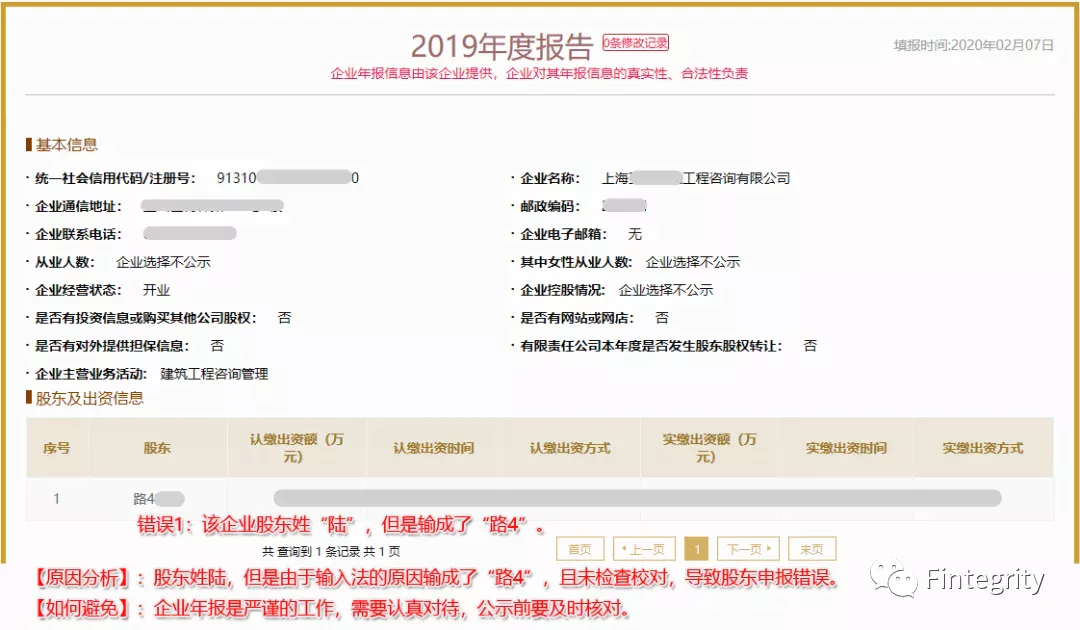

Part 2 incorrect information of shareholders

Mistake 1: the shareholder is the enterprise and has filled in as the legal representative of the enterprise

Analysis: the shareholders and the investment information are inconsistent. The above shareholders are natural persons, and the following actual information is the company.

Correct operation: the shareholders and capital contribution information shall be filled in strictly according to the contents of the articles of association. If the shareholders in the articles of association are enterprise legal persons, the enterprise name and relevant capital contribution information shall be filled in instead of the enterprise name as the legal representative of the enterprise.

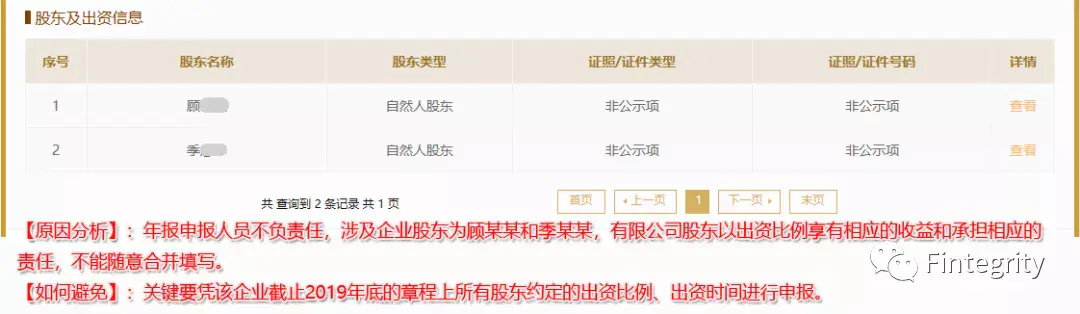

Mistake 2: the company reported that the two shareholders "sit side by side" in the annual report.

The analysis is as follows:

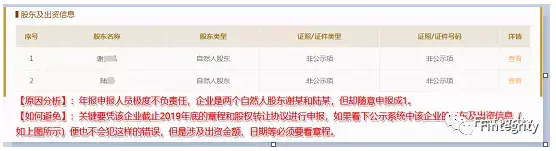

Mistake 3: the name of the company's annual report is changed.

The analysis is as follows:

Mistake 4: the company's shareholders apply for "word" and "number" mixed compilation.

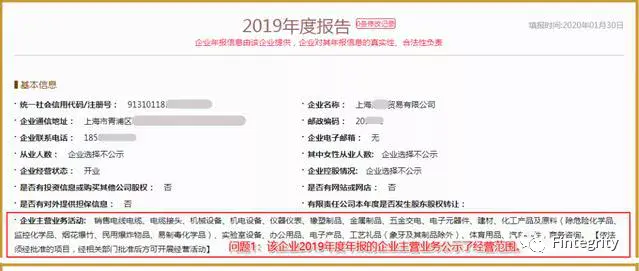

Part 3 unclear main business and business scope

Mistake: the main business has been arbitrarily filled in as the business scope

Analysis: the applicant did not analyze and summarize the company's main business, but directly copied the business scope of industry and commerce.

Correct approach: summarize and simplify the main business content according to the actual business situation.

Warm tip: financial personnel can also refer to the specific items in the company's main business income to assist in refining and summarizing.

As shown below:

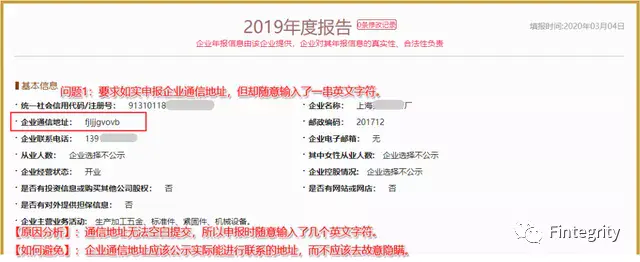

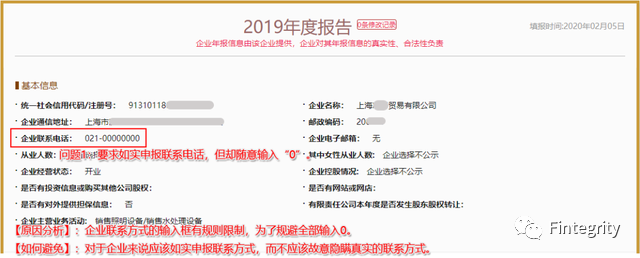

Part 4 business address and contact information are not filled in or filled out in disorder

Mistake: A string of English characters has been entered for the enterprise communication address, and the contact information is 0

Analysis: intentional concealment or random filling by the handling personnel

Correct way: fill in the address and telephone truthfully to ensure smooth communication.

Warm tip: the contact address or telephone number of the enterprise is not filled in accurately, which is the most likely situation to be included in the list of business exceptions. I hope that the accounting friends must pay attention to it when applying!

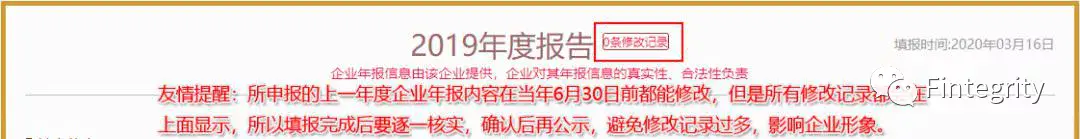

Part 5 repeated revision of industrial and commercial Annual Report

Mistake: modifying repeatedly

Analysis: failed to fill in for the first time, or filled in incorrectly.

Correct way: comprehensively check the declaration content, save first and preview again to ensure the success of declaration once.

Fintegrity tips:

1.Every modification of the annual report will leave traces. Repeated modification will cause too many modification records and create an imprecise impression. At the same time, it may also be spot checked by the industry and commerce.

2.The annual report should not be late, except for the individual, try not to carry out the annual report again in June, so as not to push the login system and affect the progress. At the same time, do well in the annual report in advance. When finding problems in the annual report, you can also set aside time for correction!

3. If the annual report is wrongly filled or omitted, it may cause the enterprise to be listed in the list of business exceptions and affect the credit investigation, which must be paid attention to.