On the afternoon of February 27, The Joint Prevention and Control Mechanism of the State Council held a press conference to introduce the support for the development of small, medium and micro enterprises and the strengthening of support for individual businesses:

Real money supports Micro and SMEs:

Reduce taxes and fees, increase loans, lower interest rates, roll over loans, insurance coverage, and relax policies

Comprehensive policy support for individual businesses:

Social security: By the unit ginseng protects enterprise worker endowment, unemployed, inductrial injury insurance, consult medium small micro enterprise to enjoy derate policy.

Tax:From March 1, 2020 to May 31, the VAT of small-scale taxpayers (including individual businesses and small and micro enterprises) in hubei province will be exempted, and the tax rate of small-scale taxpayers in other regions will be reduced from 3% to 1%.

Fee reduction: Exemption and exemption of relevant inspection and testing, certification and recognition fees for individual industrial and commercial households. For individual industrial and commercial households that have difficulties in using electricity and gas, we will implement the policy of "continuously supplying electricity and gas with overdue fees", and gradually reduce the cost of electricity and gas for individual industrial and commercial households.

01

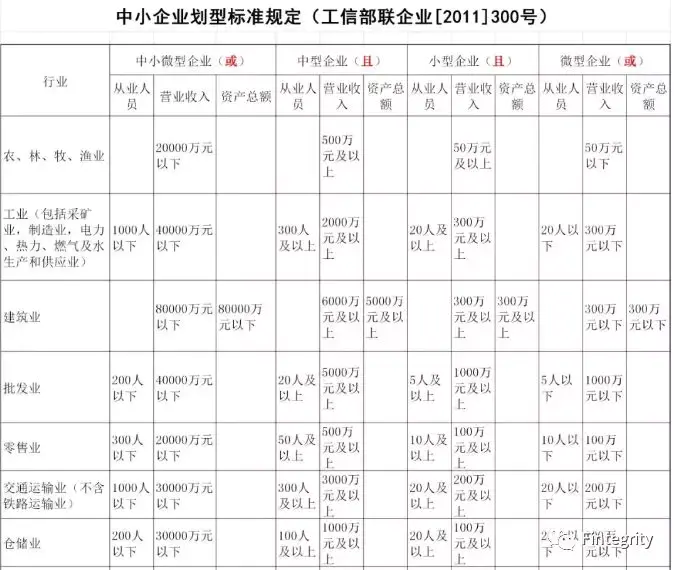

How exactly are large enterprises divided from medium, small and micro enterprises?

02

Self-employed, small-scale taxpayer, what distinction does average taxpayer have again?

Self-employed is a concept from the perspective of organizational management form, which is mainly a concept compared with the company.However, small-scale taxpayers and general taxpayers are two modes under the VAT management, which are a kind of differentiated management for both companies and individuals paying VAT. Self-employed taxpayers can be small-scale taxpayers or general taxpayers.

1

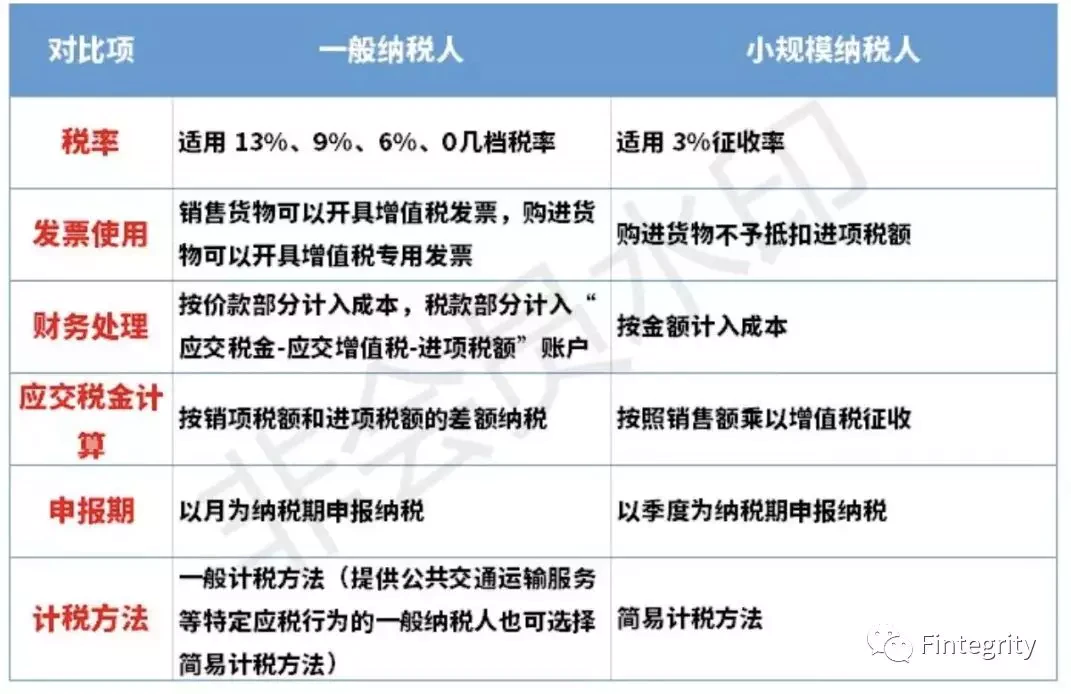

Small-scale taxpayers

2

General taxpayers

One standard: annual value-added tax sales > 500 million yuan;

Two can: Capable of sound accounting;Be able to submit relevant tax documents as required.

Small-scale taxpayers and individual businesses are cross-related, related, and different. Small-scale taxpayers include individual businesses, and small-scale taxpayers include individual businesses.Four major differences of the three:

As a financial company serving SMEs, Fintegrity's customers often encounter the problem of company registration, then:

Q: Registered companyIs to choose general taxpayer or small scale taxpayer?

A:

1. Look at scale

If the company's investment scale is large, the annual sales revenue will soon exceed 5 million yuan, it is recommended to directly identify as the general taxpayer.

If the company's monthly sales are estimated to be less than 100,000 yuan, it is recommended to select small-scale taxpayers, who will enjoy VAT exemption from January 1, 2019.

2. Look at the buyer

If your purchasers expect to be mainly large customers in the future, it is likely that they will not accept VAT invoices with a 3% levy rate. It is recommended to identify general taxpayers directly, otherwise choose small-scale taxpayers.

3. The deduction

If your company's costs and expenses constitute a high proportion of special VAT invoices, input tax deduction is sufficient, through the calculation of estimated VAT tax less than 3%, it is recommended to choose the general taxpayer, otherwise choose small-scale taxpayers.

4. The industry

If it's a 13% tax industry, it's an asset-light industry. This kind of industry general value added tax burden is higher, the proposal chooses small-scale taxpayer, choose otherwise general taxpayer.

5. See the discount

See if your industry can sell VAT preferential policies. For example, the software enterprise VAT tax return and other VAT preferential policies, if you can enjoy, it is recommended to choose the general taxpayer, otherwise choose small-scale taxpayers.

Note: this article is specific to some regions, different regions have different requirements, please consult the local industrial and commercial bureau for specific situation.